A major goal of any company, large or small, is to maximize the value of their marketing budget. To do this, many companies strive to calculate how much a new customer is worth in terms of future sales – the customer’s “lifetime value” (CLV) – in order to determine the ROI of their marketing efforts.

Calculating Customer Lifetime Value

As I stated above, the customer lifetime value approach tries to estimate how much each customer is worth in dollars over the lifetime of their relationship with the company and thus discover exactly how much a marketing department should be willing to spend to acquire each new customer.However, this approach has many challenges and often ends in failure. Why? The main reason is that in most cases these CLV models become too complicated for practical usage and therefore have little value.

The basic calculation appears quite simple upon first glance. You merely establish the customer lifetime value by estimating the average profit per sale (total revenues minus marketing, advertising and fulfillment expenses, divided by number of sales). Then you factor in how many times the average customer will purchase from you over a certain period of time (e.g. 3 years).

On the surface this seems like a quick and easy calculation. In reality, each step in the process is filled with challenges and presents opportunities for discussions and doubts. Many companies stumble due to the lack of data.

Others stumble because of senior peoples’ different opinions on which factors the CLV model should contain and how to calculate them. Disagreements usually arise when you try to:

- Determine the how much of the fixed costs should be allocated to each acquired customer

- Estimate the percentage of customers you lose

- Adjust for how many customers you would get with no marketing activities.

- Adjust values for cannibalization between channels

- Estimate CLV adjusted for seasonal changes or other complex factors

- Include the value of referrals in your calculation

- Segment customer groups or calculate one overall number for the company

Simplicity is Genius

Instead of getting into long discussions on how accurate the customer lifetime value needs to be, one should focus on simplifying the model so that ordinary people can actually use it to make smarter marketing decisions on a daily basis.

Jack Welch, former CEO of General Electric, once said:

"Simple messages travel faster, simpler designs reach the market faster and the elimination of clutter allows faster decision making."

In order to simplify the model, we need to accept that CLV calculations, as with all other marketing forecasts, can and will be inherently inaccurate. So instead of seeking to create a better CLV model, we should choose a simpler method of determining which marketing mediums to use.

One simple method that you can use is marketing cost per sale. The marketing cost per sale is calculated by dividing your total marketing expenditures in a certain time period by the total number of sales generated in the same period. This calculation gives you some insight into the return on investment of each marketing dollar while avoiding the complexity of CLV. It is fast, simple and thus powerful.

Simple Messages Travel Faster

For example, if your marketing budget is $2,000,000 per month and you sell 5,000 widgets in the same month, your average marketing cost per sale is $40.

A lot of seasoned marketing professionals will debate the accuracy of this simple model. When this happens, it's important to stay focused on the actual goal of the model, which is to provide marketers with an easy-to-use tool that they can use to make smarter marketing decisions on a daily basis.

Practical Usage:

Monthly marketing budget: $2,000,000

Number of widgets sold per month: 50,000

Average marketing cost per sale: $2,000,000 / 50,000 = $40

If I invest $50,000 in a banner ad campaign on www.vg.no (Norway'slargest newspaper) and get 2,500 sales from the campaign, the marketing cost per sale is $20.00.

If I invest USD $20,000 in a banner ad campaign on www.dagbladet.no and get 2,000 sales, the marketing cost is $10.00.

If I invest $25,000 on Google Adwords and get 6,250 sales, the marketing cost is $4.00.

If I move the $70,000 I spent on banner ads over to Google Adwords, it would give me 17,500 sales instead of the 4,500 sales I obtained with the $50,000 and $20,000 investment in newspaper banner ads.

Of course, there is a limit on the search volumes but until you reach that volume, the goal is to move your marketing budget gradually over to the channels that have the lowest marketing cost per sale. The idea is that if I can identify a marketing channel that gives me more customers for the same budget, a natural reaction should be to allocate more marketing money into that channel.

How to Get Started

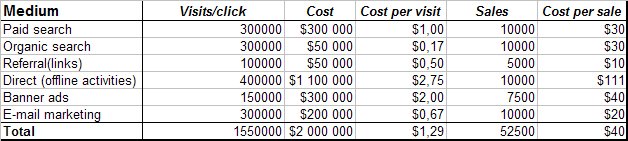

In the Medium ROI report in your web analytics software(i.e. Google Analytics, Clicktracks, Webtrends), it is possible to accurately measure the results of different online marketing activities (banner ads, affiliate programs, search engine marketing, e-mail marketing). You can tell exactly how many sales your latest e-mail campaign generated and how your banner ads do compared to your search engine marketing efforts. Then by simply dividing by the marketing costs for the different activities, you can estimate the marketing cost per sale in each channel.

Since it's very difficult to measure the effect of offline advertisements (TV,radio,etc), we can make the assumption that the cost per sale from these channels is equal to or greater than the average cost per sale for all marketing activities. Many people will argue that this assumption is too inaccurate and/or biased but, more likely than not, the cost per sale for offline activities will be much higher than the average cost per sale for online activities.

Cut Costs and Report results

At the end of every month, you should take a look at your marketing allocation chart to see whether you managed to move money into more cost-effective channels. If you continue to gradually move your marketing funds towards the low-cost channels, you'll see marketing savings for your company. Your monthly marketing allocation might look like this:

All numbers are fictive numbers

A good salesperson knows what it takes to make a sale. They know how many phone calls they have to make to set up a meeting and they know how many meetings it takes to make a sale.

A good marketer should also know what it takes to make a sale. They should know how many searches/impressions have to be made to get a qualified click and they should know how many qualified clicks it takes to make a sale.

Sources: